Roth Ira Contribution Limits Non Working Spouse

Even if you are above irs limits to deduct an ira or contribute to a roth ira you can still contribute to a non deductible ira.

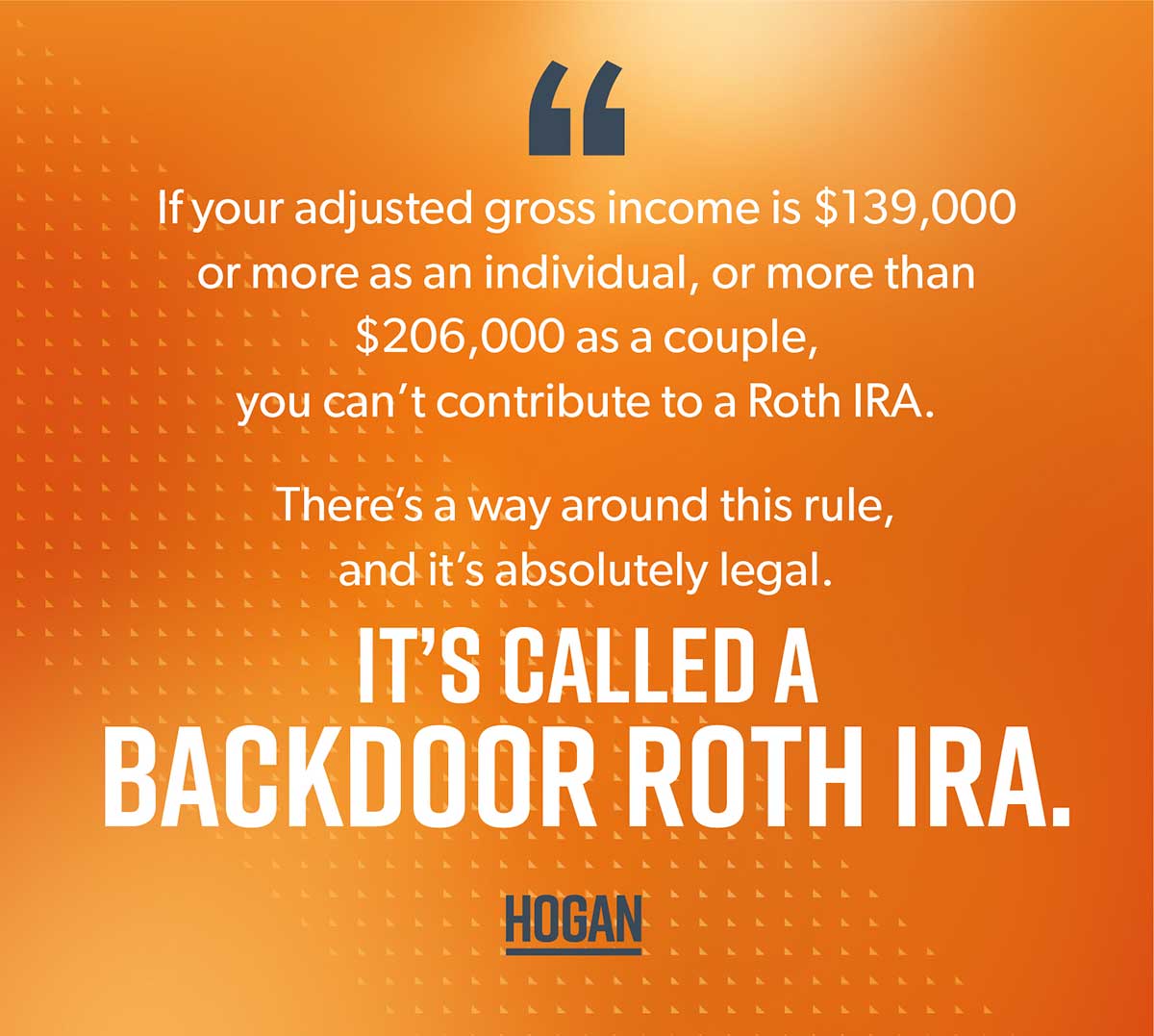

Roth ira contribution limits non working spouse. A backdoor roth ira allows taxpayers to contribute to a roth ira even if their income is higher than the irs approved amount for such contributions. The annual contribution limit for 2019 is 6 000 or 7 000 if you re age 50 or older. Through a spousal individual retirement account or ira. In 2020 you can contribute up to 6 000 to a traditional ira or 7 000 if you re 50 or older as long as your taxable compensation is at least that much.

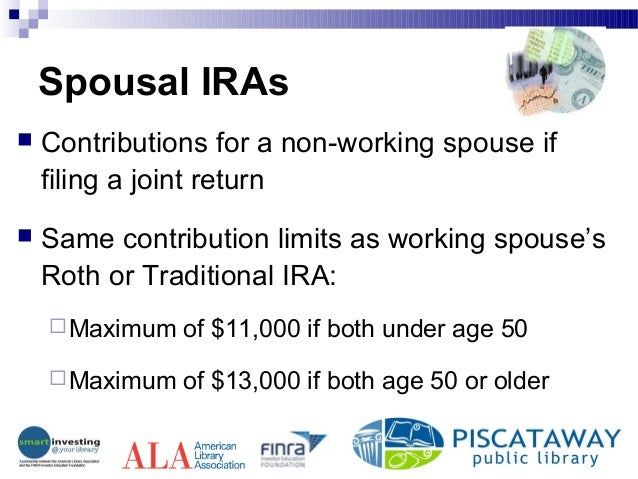

Spousal ira contribution limits the same annual limits apply to iras whether they are set up on behalf of a spouse or not. A spousal ira is a strategy that allows a working spouse to contribute to an ira in the name of a non working spouse to circumvent income requirements. Retirement topics ira contribution limits. Investors older than 50 years old if they re older than 50 years old ira rules say they can place up to 7 000.

Investors 50 years old and below according to the irs investors can now contribute up to 6 000 if they re 50 years old and below. A spousal ira is a strategy that allows a working spouse to contribute to an ira in the name of a non working spouse to circumvent income requirements. What is the ira contribution limit in 2020. 6 000 7 000 if you re age 50 or older or.

That means you can contribute to a spousal ira for a non working spouse. 6 000 is her contribution limit because 6 000 is less than. A non working spouse can also contribute up to 6 000. The annual contribution limit for 2015 2016 2017 and 2018 is 5 500 or 6 500 if you re age 50 or older.

If the working spouse has earned income equal to or greater than the combined contribution limits for each spouse both spouses can make full contributions. Contribution limits for a spousal ira are the same limits as for traditional and roth iras. Your roth ira contributions may also be limited based on your filing status and income. But there is another way for a non working spouse to save for retirement.

For example if a working spouse has 9 000 of earned income and contributes 5 000 to her ira the nonworking spouse could contribute only 4 000 to his ira. Your taxable compensation for the year if your compensation was less than this dollar limit. For 2019 your total contributions to all of your traditional and roth iras cannot be more than.