Roth Ira Income Limits 2019 Phase Out Calculator

193 000 if filing a joint return or qualifying widow er.

Roth ira income limits 2019 phase out calculator. 2019 ira deduction limits effect of modified agi on deduction if you are covered by a. If the amount you can contribute must be reduced figure your reduced contribution limit as follows. This table shows whether your contribution to a roth ira is affected by the amount of your modified agi as computed for roth ira purpose. Subtract from the amount in 1.

Whether or not you can make the maximum roth ira contribution for 2020 6 000 annually or 7 000 if you re age 50 or older depends on your tax filing status and your modified adjusted gross income magi. If your income happens to fall within the phase out range you are only allowed to make a prorated contribution. 2017 ira deduction limits effect of modified agi on deduction if you are covered by a retirement plan at work. If you file taxes as a single person your modified adjusted gross income magi must be under 137 000 for the tax year 2019 and under 139 000 for the tax year 2020 to contribute to a roth ira and if you re married and file jointly your magi must be under 203 000 for the tax year 2019 and 206 000 for the tax year 2020.

The 2019 ira catch up. Find out if your modified adjusted gross income agi affects your roth ira contributions. 2019 federal income tax calculator. Roth ira contributions will be limited for higher income earners.

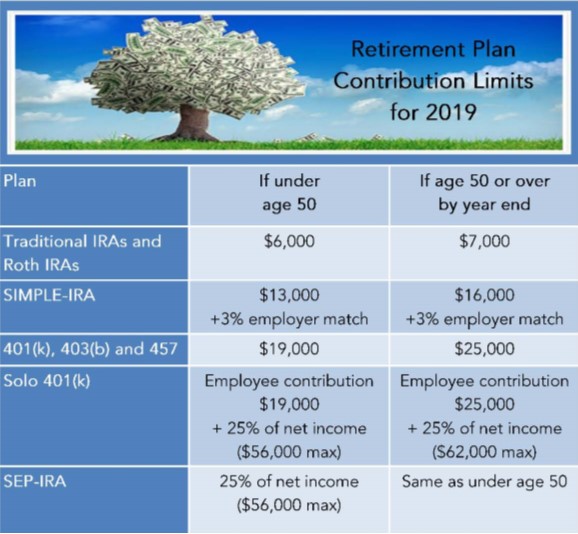

The result is your reduced contribution limit. Start with your modified agi. Many factors can affect your eligibility and contribution limits to either the traditional ira or. Roth ira contribution limits income limits 2019 2020 the annual roth ira limit is 6 000 in both 2020 and 2019 up from 5 500 in 2018 if you re 50 or older you can add 1 000 to those amounts.

Your contribution can be reduced or phased out as your magi approaches the upper limits of the applicable phase out ranges listed below. Use this roth ira calculator to determine your contribution limit for the 2019 tax year. From the maximum contribution limit before this reduction. Ira contribution limits income phase out limits for 2019 and 2020 the 2019 ira contribution limit for traditional and roth iras is 6 000 if you re under age 50.

Should i adjust my payroll withholdings. If your income exceeds the phase out range you will not qualify to make a contribution to a roth ira.